First things first, what is a Securities Exchange? It is a marketplace where licensed traders meet to trade securities, derivatives or commodities. Let’s refine this definition by describing what securities, derivatives and commodities are.

What is a Security?

A security is a claim/right of ownership on a portion of income and assets of an entity. Example: Safaricom share. Simply put, when you purchase/invest in a security, you have a guaranteed ownership of a piece of the income and assets of a business.

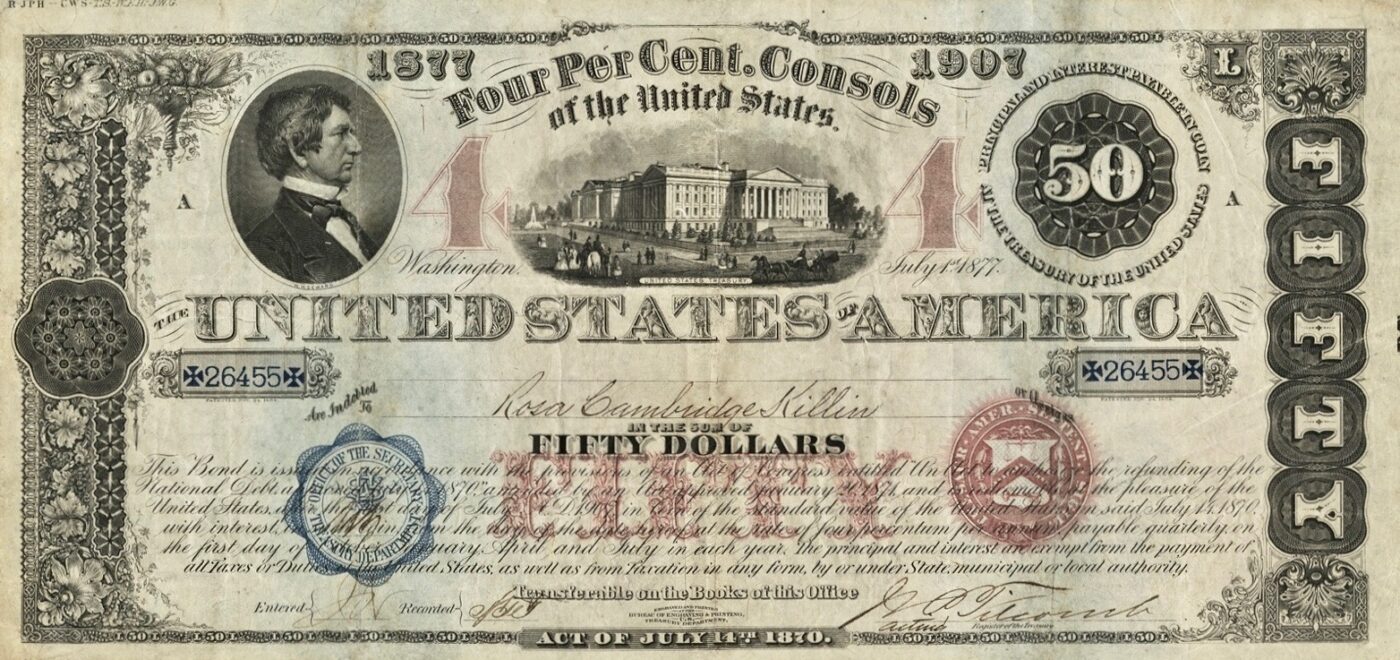

What happens to the money you spent? The money is treated as either a debt or equity security by the company. If you buy a debt security such as a bond, you have a prior claim on the assets of the business and the business is obligated to pay you interest and a portion of the principal at agreed intervals. If they fail to meet this obligation, you may seek redress in a court of law, to seize the business’ assets since you have a prior claim. The image below shows a Consol Bond which was a perpetual bond by the government (the government makes payments perpetually).

Image source: Consol Bond (Wikipedia)

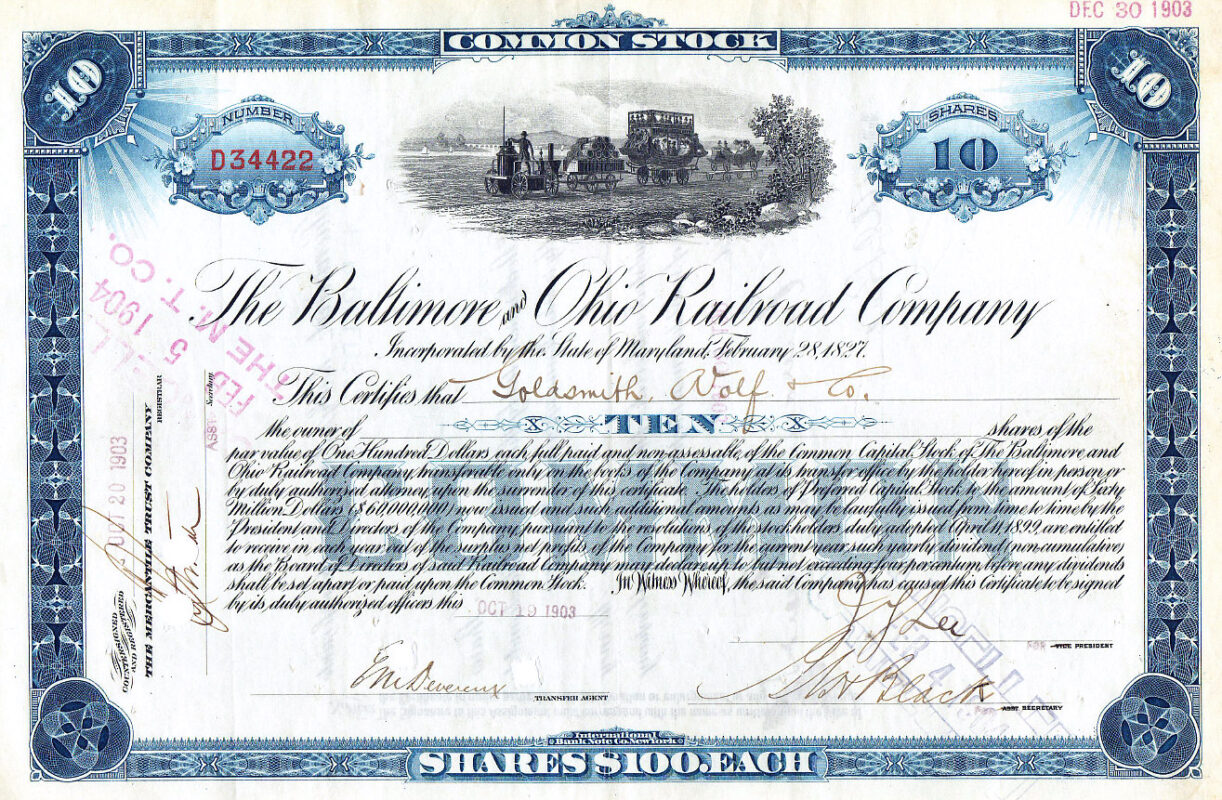

The second type of security is an equity security which represents a residual claim on the income and assets of a business for example ordinary shares also called common stock. In this case, residual claim on income means you will be paid a portion of the income called dividends after the debt security holders have been paid interest plus a portion of the principal. A residual claim on assets means if the company is unable to meet its obligations you shall receive the remaining assets once the debtholders have stripped the business off its assets.

Image source: Baltimore Ohio Railroad Company Common Stock Certificate, 1903

Commodities and Derivatives

The other assets traded on an Exchange are commodities and derivatives. Commodities are physical assets that include agricultural produce, meat, precious metals, and fossil fuels.

A derivative is a type of security whose value and payoff are dependent on another asset’s performance (called underlying asset). For example, the NSE has 2 derivatives; Equity Index Futures contract and Single Stock Futures contract. A 6 months’ Single Stock Futures contract drawn on NCBA share enables a buyer (called the long position) to lock in the price of NCBA share today with the seller (called the short position) such that when the Futures contract expires in 6 months’ time, they shall transact at the agreed price and not at the prevailing price of the share. It will favour the long position if prices rise in 6-months’ time since he/she will buy at a cheaper price that was locked in the futures contract. The converse is also true, it will be favourable to the seller if prices go down but unfavourable to the buyer. This is why derivatives contracts are considered zero-sum games where one party’s gain mirror’s the counterparty’s loss. In this case we say, the Single Stock Futures derives its value from the underlying NCBA share and its price depends on the price of the share.

What is the Nairobi Securities Exchange?

Nairobi Securities Exchange (formerly, Nairobi Stock Exchange) is Kenya’s Securities Exchange and was founded in 1954.

What role do they play? Key functions include:

- Providing a transparent platform for efficient transfer and allocation of capital, that is essential for economic growth. This ensures capital flows from those who have excess money but have no productive use to those who need the money to invest in development of a product or render a service. This spurs economic growth.

- NSE sets guidelines for all trading participants to ensure an orderly and fair trading platform. For example, it prescribes the guidelines for listing a company on the exchange.

- Provides a platform that enables standardised pricing of securities based on unbiased and objective forces of demand and supply.

How do they make money? Main Income streams:

- Transaction levies charged on securities – NSE earns a portion of the transaction fee when securities are traded.

- Data vending income – NSE sells share price & market analysis data that empowers investors to make informed investment decisions.

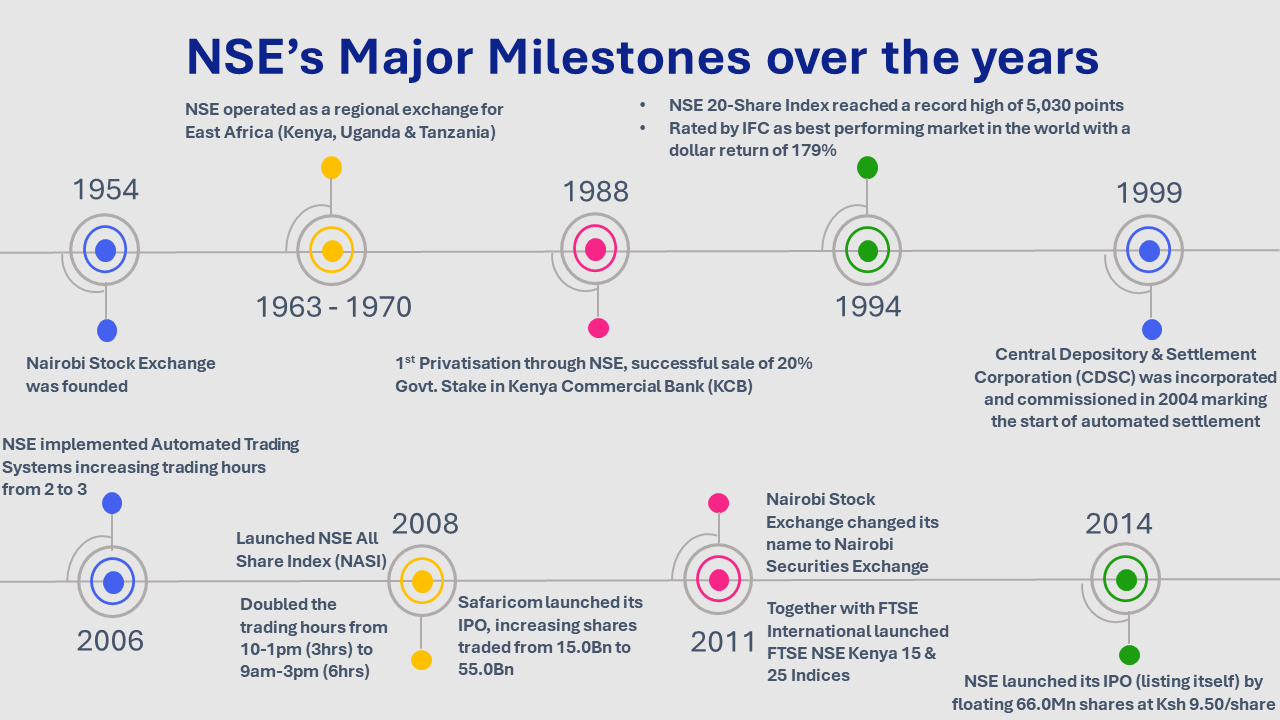

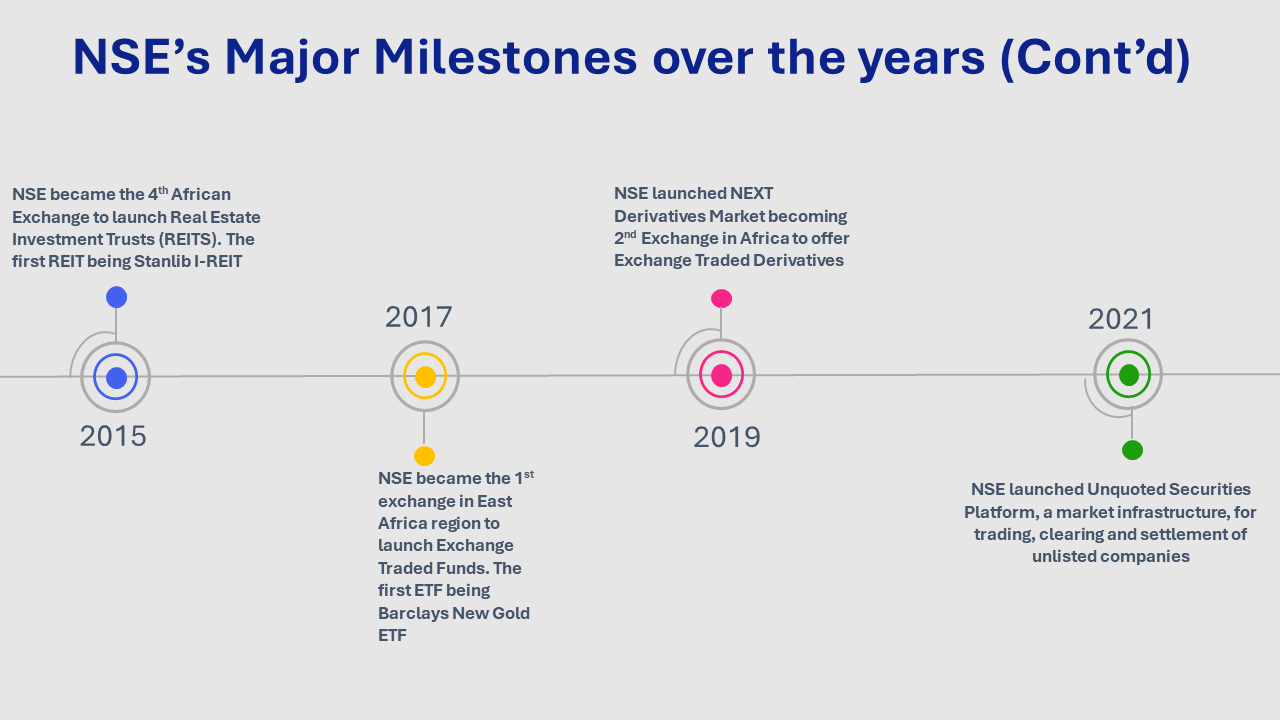

What are NSE’s major milestones over the years?

Data source: www.nse.co.ke

Kenya’s Capital Markets Ecosystem – A simplified illustration using Athletics Analogy

We can use an Athletics Event like the Olympics to describe how the Kenya’s Capital Market Ecosystem works.

Q1. Why is the Olympics a good description of Kenya’s Capital Markets? The Kenya Capital Markets can be likened to Olympics. Just like in the Olympics, different events are happening con-currently, and every participant wants to win. In our case, let’s say we have 3 unique events taking place con-currently. The 1st event is the Stock market whose participants are shares of various companies. The 2nd event is the Bond market, whose participants are Bonds and finally the 3rd event is Derivatives market, that has equity index futures and single stock futures as the participants.

Q2. Where do the 3 events take place? The events are hosted in a stadium called NSE’s Automated Trading System (ATS). ATS is a platform that tracks and displays live results of all events (real-time prices of shares, bonds & derivatives). The NSE opens the stadium at 9am and closes it at 3pm (All events/markets open at 9am and close at 3pm).

Q3. Who are the fans in the stadium? The fans are the Investors. These are people who own a Central Depository System account (A trading account). They can be individuals (retail investors) or companies/institutions (institutional investors). How can you get a ticket to the stadium or how can you gain access to the Capital Market? You need to open a CDS Account by visiting any licensed broker.

Q4. Do the Fans only spectate? No, they also speculate on which player will perform well or poorly. In real life, fans possess trading cards of their favourite players. These trading cards can be a piece of ownership of either a share, bond or a position in a derivative. Trading is like buying and selling trading cards of your favourite players (Different securities & derivatives) who participate in the 3 events (bond markets, stock markets, derivatives markets). If a player is not playing well, fans will sell the trading card and if they perform well, fans will fight each other to buy that player’s trading card. As mentioned earlier overarching goal of why the Trading exists is to attain efficient allocation and transfer of capital to spur economic growth.

Q5. Can the fans trade trading cards in their own account? No, they need to a trade their trading cards through a bookmaker called a Broker. The rules of Capital Markets Authority (CMA) state that investors cannot trade directly in their own account, they must hire licensed brokers to execute trades on their behalf. The Investor pays the Broker a fee on every trade called a brokerage fee. Examples: Stockbrokers like Faida Investment Bank, Genghis Capital, Kingdom Securities etc.

Q6. How do the fans get insights on which trades to execute? Sport Analysts/Pundits analyse information on historical performance of the various players and approach fans to offer these valuable insights that may increase the fan’s chances of gaining from a trade. If the fan is convinced, he/she allows the Pundit to manage their money and generate a return at a fee. The Pundit gains full control of their CDS account and can instruct brokers to execute trades. The Investment Firms use their resources and expertise to come up with a portfolio (combination of trades) that would best suit the Investor’s risk and return objectives. The Investor pays the Investment Firms an Annual Management Fee for their services. Examples: Fund Managers like CIC Asset Management, Hedge Funds like MansaX, Investment Banks like Standard Investment Bank.

Q7. Who is the referee/technical official? The Nairobi Securities Exchange. The NSE oversees all competitions and trading to ensure guidelines are followed. They also convene and close the competitions (They open the markets at 9am and close them at 3pm). They have the power to halt a certain athlete from participating (Halt the trading of a security) if guidelines are not followed. For example, a fraud inquiry into a company might result in its shares halted from trading until the matter is investigated.

Q8. Who is the “Federation” that sets the rules of the game? Capital Markets Authority (CMA) can be considered to play the role of “IAAF” and being “The Watchdog”.

CMA’s main role:

- Sets the rules of all events and trading that take place in the stadium. They provide regulatory framework in which all Fans (Investors), Bookmakers (Brokers), Sport Analysts (Investment Firms) or Athletes (Issuers of Securities or Derivatives) must comply with.

- Acts as the ‘Watchdog’. They oversee whether rules & regulations of are followed during game time. Penalizes any violation by either Fans, Bookmakers, Sport Analysts or Athletes

- Licensing the Bookmakers (Brokers). Assesses the eligibility of Brokers to execute trades on behalf of Investors and then awards the licenses.

Data source: www.cma.or.ke

I hope this improves your understanding of how Kenya’s Capital Markets work and the roles of the various participants.

If you have any questions or wish to discuss further, you can reach out to me via email: [email protected]

Connect with me on LinkedIn: Fundi Mwaniki

If you wish to view performance analysis of all companies listed on the Nairobi Securities Exchange, click here: My Portfolio

Asante.